Blog

June Recap by Jack Moller

Submitted by Moller Financial Services on July 6th, 2016

I’m guessing close to all of you have read about (been inundated with?) the surprising vote by the United Kingdom to leave the European Union after 40-plus years. What strikes me is the utter futility in trying to predict what will happen. My goodness, the experts were so wrong on the outcome of the vote with all of the polling data etc. that the idea they are going to successfully predict the future path amid the mind boggling complexity just doesn’t make sense to me.

Keep Calm and Carry On by John Nowak

Submitted by Moller Financial Services on June 28th, 2016

The slogan “Keep Calm and Carry On” was created by the British government in June 1939 as a way to raise morale before World War II. While the stakes are much different, investors may need similar moral support today after citizens of the United Kingdom unexpectedly voted in favor of exiting the European Union last week.

Legendary Keys to Success by John Nowak

Submitted by Moller Financial Services on June 21st, 2016May Recap by Jack Moller

Submitted by Moller Financial Services on June 10th, 2016

Pardon My Tardiness

I apologize for the lateness of this commentary. Last week I returned from “conference week” in Texas and brought back much to ponder as well as a flu bug that’s kept me home sick for awhile. My first conference was John Mauldin’s “Strategic Investment Conference” (SIC) in Dallas followed by a sort of health symposium called “Paleo-FX” in Austin. Maybe I should find a different “health” conference next year that doesn’t get me sick?

Now We Know What the Future Holds! by Nate Eads

Submitted by Moller Financial Services on May 27th, 2016

“I’ll be working until the day I die”. Could this be Carnac the Magnificent’s answer to the question of “Will investors ever have enough money to retire?”

How Long Is "Long Term"? by John Nowak

Submitted by Moller Financial Services on May 4th, 2016

One of the most common sentiments I hear today when it comes to investing is that of frustration with the markets. After all, the global stock market index is at the same level as it was two years ago (April 2014 to April 2016), but with a lot of ups and downs. I understand and join you in frustration! Two years can seem like a long time to wait for the reward of investing with a disciplined and diversified plan. However, two years is not very long when we speak of “long-term investing”. So how long is “long-term” anyway?

April Recap by Jack Moller

Submitted by Moller Financial Services on May 1st, 2016

Highest Volatility in Years

These first four months of 2016 have been the most volatile since the onset of the dot-com blow up in 2000 with huge swings in both directions. April continued the trend selling sharply early and at the end of the month sandwiched around a nice mid-month rally. The net of the month and the year-to-date swings has been just a bit over 1% appreciation in the large-cap, S&P 500 and Dow Jones Industrial indices.

The increased volatility has not been particularly surprising as the lethargic, global economic recovery is being counterbalanced by worldwide central banks keeping the monetary spigots wide open, though with seemingly less effect:

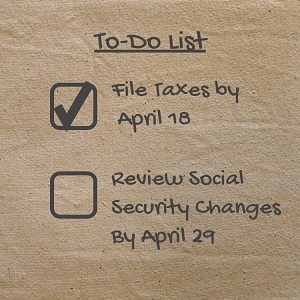

Last Call for Social Security Loopholes by John Nowak

Submitted by Moller Financial Services on April 20th, 2016

In October 2015, Congress passed the Bipartisan Budget Act of 2015 which included the “Closure of Unintended Loopholes” provision. This provision eliminates two Social Security retirement benefit claiming strategies available to married couples. Effective April 29th, couples will no longer be able to “file-and-suspend” a worker benefit while collecting a spousal retirement benefit. People ages 66 to 69 have less than two weeks to be grandfathered in with the old file-and-suspend claiming rules.

March Recap by Jack Moller

Submitted by Moller Financial Services on April 4th, 2016Janet Yellen: “Caution is especially warranted”

The stock market has continued its yo-yo behavior of the past couple of years as the mid-February market bottom held with the S&P 500 continuing its rally from there to get all the way back to even for 2016.

_0.jpg)