Last Call for Social Security Loopholes by John Nowak

Submitted by Moller Financial Services on April 20th, 2016

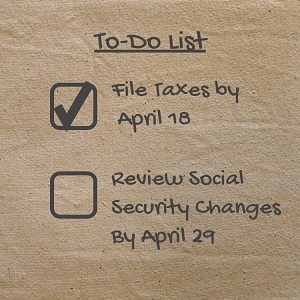

In October 2015, Congress passed the Bipartisan Budget Act of 2015 which included the “Closure of Unintended Loopholes” provision. This provision eliminates two Social Security retirement benefit claiming strategies available to married couples. Effective April 29th, couples will no longer be able to “file-and-suspend” a worker benefit while collecting a spousal retirement benefit. People ages 66 to 69 have less than two weeks to be grandfathered in with the old file-and-suspend claiming rules.

In this post, you will gain a brief understanding and background on Social Security’s financial problems. Then, we will offer suggestions for those who will be affected by the upcoming change.

Social Security Troubles

Everyone knows the Social Security program is in trouble. In 2003, the Social Security Trustees Report projected the disability fund would be exhausted in 2028 while the “retirement” (old age and survivor) fund would be depleted in 2044 (Social Security has separate funds for disability and retirement). Twelve years, three presidential elections, a global financial crisis, and 10 iPhone versions later, these estimates look much worse.

The 2015 Annual Report stated “projected reserves of the DI (Disability Income) Trust Fund decline steadily from 40 percent of annual cost at the beginning of 2015 until the trust fund reserves are depleted in the fourth quarter of 2016. At the time reserves are depleted, continuing income to the DI Trust Fund would be sufficient to pay 81 percent of scheduled DI benefits.” In other words, the disability trust was scheduled to run out of money later this year, 12 years sooner than expected.

With a depletion period of less than one year for the disability trust, Congress finally acted and passed the “Closure of Unintended Loopholes” provision. While this law only affects retirement claiming rules, the savings are being re-directed to fund Social Security disability claims. As a result, the disability trust is expected to provide 100% benefits for an additional six years – until 2022.

If the Social Security disability trust is in a dire situation, the retirement trust might be described as troubling. In 2003, the Trustees Annual Report estimated the retirement trust fund would be depleted in 2044. The 2015 Annual Report projected the retirement trust would be now exhausted in 2035 when retirees could then collect 73-79% of their original benefit – nine years earlier than previously expected.

Social Security “Loopholes” Ending

Now that we have an understanding of why Congress changed the Social Security laws, let’s review what “unintended loopholes” are being closed. In addition, we will offer potential next steps for those planning for and/or in retirement. There is one important caveat: every person’s financial situation and plan is different and these suggestions may not be right for everyone. Speak with your advisor about incorporating these, or any income strategies, into your personalized retirement plan.

File and Suspend

- Under this rule, the “worker” applies for and voluntarily suspends retirement benefits (age 66-69).

- Worker’s benefit grows by 8% per year until age 70 (known as delayed retirement credits).

- Then, the spouse files for benefits on worker’s benefit record, collecting up to 50% of the worker’s benefit.

- If worker file and suspends before April 29th, the couple is grandfathered in with the old spousal benefit AND delayed retirement credit rules.

- After April 29th, couple can decide to receive the spousal benefit or the delayed retirement credit, but not both.

Restricted Application

- Under the old rule, a 66 to 69-year-old can choose between two benefit options:

- Receive their own worker retirement benefit or

- “Restrict” their benefit to a spousal 50% benefit

- Allowing their own benefit to grow 8% per year

- Under the new rule, Social Security will automatically pay the larger of the spousal benefit or the worker benefit

The Restricted Application loophole change affects people younger than age 62 as of January 1, 2016. Therefore, someone age 62 today will still have eight years to use the old restricted application rules. No action is necessary today, but it is important to be aware of this benefit.

Final Thoughts

For those younger than 62, it is important to note that even if the Social Security trust is exhausted, there is still expected to be enough income tax from tomorrow’s workers to provide 73-79% of today’s stated retirement benefits. This scenario is a lot better than most people realize. The glass is more than half full.

Social Security last changed the full retirement age in 1983 – from age 65 to today’s age 66 or 67, depending on birth year. Since then, life expectancy in the U.S. has increased 4 years. This increase represents almost 50% of the expected retirement period in 1983. Revising the retirement age again and implementing other changes can go a long way towards making the Social Security fund strong again.

In the meantime, please contact us if you have specific questions related to the upcoming Social Security retirement benefit changes.