September 2017 Update: Falling Dollar = Stronger International Markets by Jack Moller

Submitted by Moller Financial Services on September 10th, 2017

It seems like just yesterday when I was writing about the very strong U.S. dollar and its impact on the investing landscape. The tide has turned abruptly in 2017 as, after the dollar had set a multi-year high at the turn of the year, it has fallen precipitously. Thus, the non-dollar-denominated assets (international stock and bond funds) have had the tailwind of built-in appreciation this year. While it has been nice to have the currency gains this year, in the long run, the key to the funds’ performance will be the performances of the individual stocks in their portfolios. Currency gains/losses should mostly cancel out over the years if history is any guide.

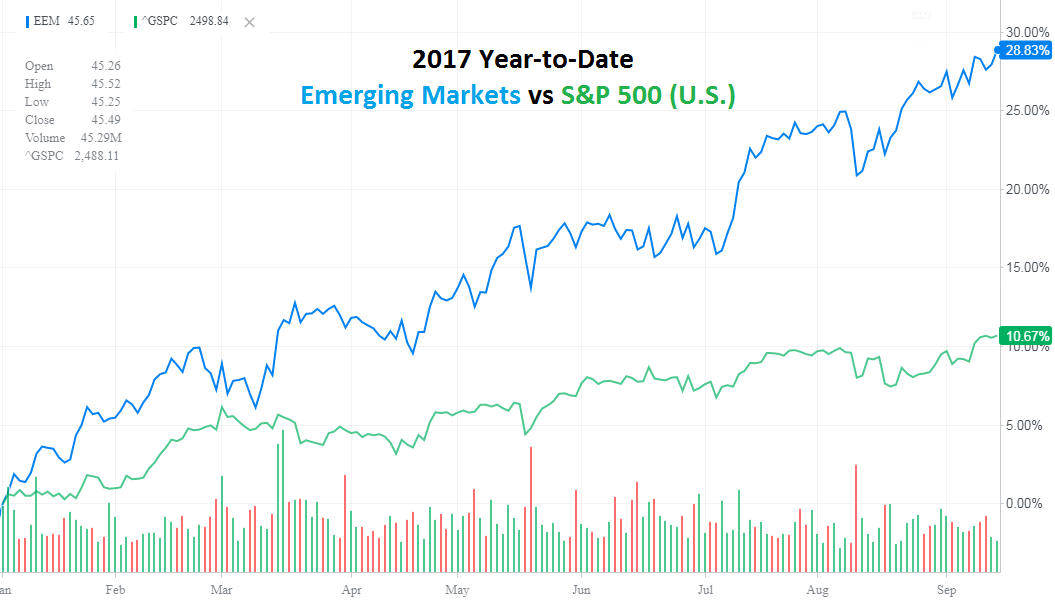

Emerging Markets Continue Streaking Higher

The big winners in markets so far this year have been the emerging markets which have put their past years’ struggles in the rearview mirror. In fact, the emerging markets index followed up its ~5% gain in July with another fine month in August, gaining nearly 3%. While we would not be surprised if emerging markets consolidates after its sharp advance, there are many reasons to remain long-term optimistic. In particular, these markets should benefit from recovering earnings, faster economic growth, favorable valuations, and stabilization in China and the commodities markets.

While emerging market stocks have enjoyed a terrific 2017 year-to-date (see below), it is important to be emotionally prepared for a correction whenever it does occur. Nonetheless, these underlying positive fundamentals should benefit this asset class in the intermediate to long-run.