October 2017 Update: Market’s Cruelest Month … Not So Cruel by Jack Moller

Submitted by Moller Financial Services on October 2nd, 2017

Many of us think of October as the worst month of the year for the stock market. This perception no doubt stems from October being the month of the two biggest stock market crashes in history – October 29, 1929 and October 19, 1987. But, alas, the reality is that September has been the month with the worst average return while many Octobers have been very strong.

Heading into September this year, many market participants braced for the worst as the market faced many challenges. To name a few:

- Potential (nuclear) war with North Korea

- Federal Reserve meeting with anticipation that they would unveil their plans to continue hiking interest rates as well as a schedule for shrinking their balance sheet, a process that some have labeled “quantitative tightening”

- Looming federal budget showdown with debt ceiling issues coming in to play

- Continued dysfunction and nastiness in our nation’s capital

- Devastation of hurricane Harvey and the pending arrival of hurricane Irma which turned out to be two of the biggest natural disasters in U.S. history

Amazingly, and humbling to me, the market basically shrugged these off and continued to march/plod higher in September. Once again, trying to predict how the market might react to events that in themselves are unpredictable shows what a total waste of time it is to be in the prediction business.

Fed Takes a More Hawkish Stance

In the statement following the Fed’s September meeting they sounded more resolute in their expectation of continued interest rate hikes with the next one anticipated in December. Perhaps more importantly, they indicated that they will begin to pare their bloated balance sheets. As we’ve noted over the last few years, the implementation of extraordinary measures as an outgrowth of the Great Recession included using the “quantitative easing” (QE) tool whereby they purchased trillions of dollars of government bonds and mortgage-backed securities. These bond purchases were designed to calm the markets by bidding up bond prices and thus forcing down interest rates.

In this month’s meeting, they confirmed their plans to begin to cut back on their holdings by discontinuing their process of reinvesting all proceeds from maturing bonds. Initially, they will allow $10 billion per month to run off without being reinvested and then gradually increase to $50 billion per month. The Fed’s announcement did have a negative impact on the bond market with rates rising and prices falling. Importantly, this mild rise in interest rates did not phase the stock market.

Surprising Election Result in Germany Hits the Euro

The dollar’s steady decline was interrupted this month as a couple factors came into play. Besides the rolling out of the Fed’s plans, the big news was a disappointing election in Germany for incumbent chancellor Angela Merkel. While she was re-elected, her party lost many seats and a far right party gained. Apparently, while Germany as a whole continues to chug along as an exporting juggernaut, the benefits have flowed mostly to the western part of the country leaving much of the east disgruntled.

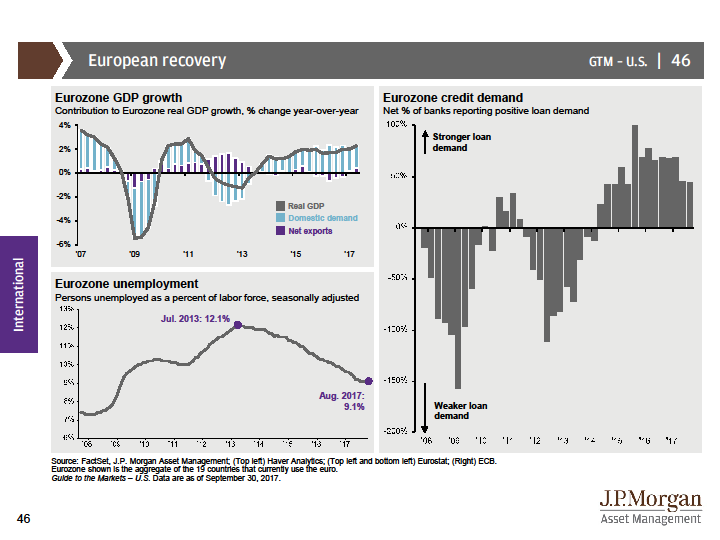

As Europe’s economic powerhouse, and a key driver behind the strong Euro, Germany’s election jolted the markets, leading to a weakening Euro and corresponding strengthening dollar. While many international markets mutual funds and ETFs are denominated in Euros and likely were hurt by that weakness, ultimately many European companies should benefit from the cheapening currency. Thus, the MSCI Europe stock market index actually was one of the big winners for the month, gaining around 3%. How long this trend continues is anybody’s guess, but as shown in the charts below, Europe’s demand for loans, GDP, and unemployment have all drastically improved over the last two years.