First Generation Financial Planning by Emily Murphy, CFP®

Submitted by Moller Financial Services on January 25th, 2021

First Generation Financial Planning by Emily Murphy, CFP®

Most Americans cite their parents as their primary influence on how they handle money as an adult and as their primary source for learning financial concepts like budgeting and saving.1 2 First-generation college students face unique challenges compared to their peers who had a parent that went to college including guilt and difficulty fitting in.3 It can be trying to navigate an already difficult path in life without a guide who has been there before. Likewise, there are unique problems when being the first generation in your family to manage money.

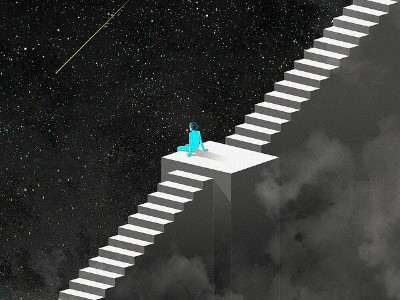

In the United States, a family’s place on the economic ladder is a strong predictor that their children will end up on the same place on the ladder. According to a Pew Charitable Trusts study, only 4% of those raised in the bottom quintile will beat the odds and move up to the top quintile as adults.4

Despite the relative unlikelihood, 4% of US children roughly equals 3 million future adults who will have moved from financial scarcity to abundance. How does this upbringing affect a person’s future experience managing money as an adult? Some of the financial planning challenges posed by growing up underprivileged may include increased difficulty in budgeting and managing the needs of loved ones as well as amplified financial-related anxiety.

Spending

Growing up in a resource-deprived environment can affect a person’s ability to budget as an adult in several different ways. On one hand, growing up with scarcity can lead to a deep-seated fear of ending up back in that situation. That fear sometimes manifests in a miserly attitude towards money and a propensity to hoard.

Paradoxically, a precarious financial upbringing can also lead to the opposite approach to budgeting. An American Psychological Association (APA) study found that people who grew up without much money are more likely to take a small, immediate reward instead of a larger, later reward. The researchers hypothesize that when someone can’t trust that the outside world will treat them well or fairly, then they are likely to hold on to what little they can. They cite an attitude of “'we have to spend this before it disappears.” They also tend to spoil themselves as adults because they're making up for all the ways they felt deprived as kids. Poverty can tempt you to spend everything you have before it’s taken away from you.5

The APA study states that growing up in a lower socioeconomic status (SES) family also leads to differences in navigating money in social situations. One participant stated, “Where wealthier friends will happily announce that they’re cutting back, I’ll refrain from asking for money back that I’m owed or insist on buying rounds at the pub so I don’t ‘look’ poor.”

Helping Others

Growing up with financial support from family leads to an easier financial life in some obvious ways like receiving an inheritance or not being burdened with student loans. However, coming from an impoverished family situation and/or community can also lead to extra costs as family and friends may often need financial assistance. If you become one of the only people in your circle who has the means to help, it’s often difficult and painful to decide when and how to help without putting your own finances in jeopardy.

When a loved one is struggling financially, take a pause before helping in order to consider whether the problem is temporary or pervasive, and whether they have a plan for avoiding the same situation in the future. If you do help, make sure you set clear expectations between you and the person about the form of help and any terms for repayment. Make sure that, like on an airplane, you “put your oxygen mask on first” by ensuring your own financial security first before helping others.

Finally, remember you alone can’t solve everyone’s financial problems and consider directing energy and resources towards causes that work to solve the underlying causes of systemic poverty.

Money Anxiety

The stress of financial problems can wreak havoc on one’s mental health. A person’s cognitive function is diminished by the constant and all-consuming effort of coping with the immediate effects of having little money, such as scrounging to pay bills and cut costs. On average, a person preoccupied with money problems exhibited a drop in cognitive function similar to a 13-point dip in IQ, or the loss of an entire night’s sleep.6

Even after achieving financial success, growing up underprivileged increases the likelihood a person will experience financial-related stress as an adult. In one study, researchers found that the effect of uncertainty on sense of control was specifically driven by people’s childhood SES and not by their current SES. This means that people from poorer backgrounds who have achieved a higher SES as adults are still likely to feel a loss in control during uncertainty. Even if hard work is what contributed to them escaping poverty, in their minds, hard work doesn’t necessarily mean wealth because they’ve seen that effort not pay off for many of their counterparts growing up.

It is much easier to believe things are within your control when you haven’t seen otherwise time and time again. However, individuals with an internal locus of control, on the other hand, recognize that all of their financial decisions are entirely within their control, which means they make proactive decisions about their money which leads more often to positive outcomes. In order to create a “self-fulfilling prophecy” that you are in control of financial situations, the researchers suggest focusing on a memory of being in control before making any decisions. Recalling that sense of control can help you to maintain it.

There aren’t any easy answers to change the lingering mental and emotional effects of one’s upbringing, especially on finances. Accepting that your experiences were probably different than those who grew up more comfortable and recognizing the effects on your financial plan can be a good start.

Sources:

1 https://www.wsj.com/articles/BL-FAB-7687

2 https://s2.q4cdn.com/437609071/files/doc_news/research/2019/Young-Money-2019-Survey.pdf

3 https://journals.sagepub.com/doi/10.1177/2378023116664351

5 https://www.apa.org/news/press/releases/2014/08/growing-up-poor